- Personal

Personal Banking

PERSONAL LOANS & CREDIT

RETIREMENT & INVESTMENTS

Digital Banking

- Business

Business Banking

BUSINESS LOANS & CREDIT

Business Services

Digital Banking

- Commercial

Commercial Banking

Commercial Loans & Financing

Treasury Management

Additional Commercial Solutions

- Wealth

Private Wealth Management

Institutional Asset Management

Investments

Corporate Underwriting

- About Us

Community Involvement

Company

Our Insights Blog

Our Team

5.00% APY 5-Month CD

Looking for a secure, reliable way to grow your cash savings? Certificates of Deposit (CDs) can help you reach your short-term or long-term savings goals with guaranteed fixed rate returns.

What’s your Goal?

I want to

Freestyle Checking

Get the convenience and flexibility you need from a personal checking account.

- Never worry about NSF fees

- Service charge waived with one qualifying monthly transaction

- Account protection with Visa® Purchase Alerts2

Mortgage solutions

Get flexible terms, competitive rates, and the support of a local home lending expert who can match you with the right mortgage.

- Loans for more established buyers

- Government-backed loans for new borrowers

- Loans for active duty military and veterans

100+ years of turning dreams into businesses

We offer a full suite of business solutions designed to get your business started and help it grow.

- Business loans and lines with flexible terms

- Checking accounts with great service and powerful tools at your fingertips

- Merchant Services solutions to streamline your retail payments

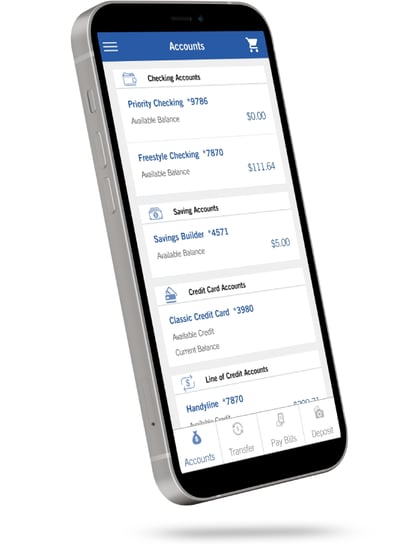

Bank where you want, when you want

Get the convenience of banking on the go or at home, with digital tools that put your account at your fingertips.

Send and receive money with Zelle1

Deposit checks with your smartphone

Shop securely with Mobile Wallet

Pay your bills in one place with Bill Pay

Why your neighbors trust Hancock Whitney

For more than a century, Hancock Whitney has been dedicated to the financial well-being of Gulf South communities.

We give back to our local communities because we're committed to the future of our region.

We're more than a bank—we're a community partner focused on giving back.

Want to explore other ways to reach your financial goals?

1U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. Only send money to people you know well and trust. If you don't know the person you are paying or are unsure you will receive what you are purchasing, then we don't recommend you use Zelle® for the transaction. Once you have authorized and made a payment through Zelle®, it may not be possible to reverse the payment or recover the funds.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

2Actual time to receive a transaction alert is dependent on wireless service and coverage within area. Message and data rates may apply. Some PIN-based debit transactions may be routed through non-Visa networks. Transactions routed through non-Visa networks will not trigger a purchase alert. For more information about Purchase Alerts, including any limitation and restrictions, go to www.hancockwhitney.com/purchase-alerts.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay is a trademark of Apple Inc.

Android is a trademark of Google Inc.

Proud to be an official sponsor of

Hancock Whitney Bank, Member FDIC and ![]() Equal Housing Lender. All loans and accounts subject to credit approval. Terms and conditions apply.

Equal Housing Lender. All loans and accounts subject to credit approval. Terms and conditions apply.

Hancock Whitney and the Hancock Whitney logo are federally-registered trademarks of Hancock Whitney Corporation. © Hancock Whitney 2024

![]()